SEZ: Policy for Plunder

SEZ: Policy for Plunder

Buddha and other state governments become crazy with special economic zone (SEZ). Mainstream media have been portraying SEZ as panacea for Indian economy. They claim that SEZ will bring up enormous job opportunities and in turn eradicate poverty.

We know in all over India for SEZs different state governments has been planning to acquire lakhs of acres of land, most of which is farmland. Naturally people do protest and place like Nandigram the people’s resistance becomes too difficult to crackdown even after bloodshed.

A section of intellectuals and middleclass believe that this resistance is due to the unawareness of people and SEZ can change the face of India. They oppose people’s resistance and for them whoever oppose SEZ and land acquisition is anti-development and their actual aim is to keep people poor.

Let’s consider the whole issue.

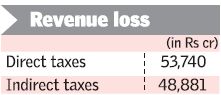

A policy was introduced on 1.4.2000 for setting up of Special Economic Zones (SEZ) in the country with a view to provide an internationally competitive and hassle free environment for exports (1). But, why it is ‘special’? It is special, because industries in SEZ will have some definite advantages. They will be under huge tax exemptions. And apart from production, within SEZ township could be built up. There will be full authority to provide services like water, electricity, security, restaurants, recreation centers etc. on commercial lines (1). That means government will do everything to secure their maximum profit. But, this will cost really high price. For a period of four years, 2006-07 to 2009-10, the total revenue loss due to tax exemption to SEZ will be more than 1 lakh crore (3). It simply means that we, the Indian people have to subsidize this much amount directly to these big companies who will develop SEZs and set up industries over there. It simply shows that government (state or central) encourages SEZs to protect the interest of big companies and corporations. Since, in the existing laws, they are bound to pay taxes (it is different issue, how much they actually pay) and there could have been nation wide protest if government changes these laws, they have just made a new policy on April 1, 2000 to keep big companies out of taxation. And this is what they call as SEZ.

Mainstream media and the advocates of SEZs argue that the boom of job opportunities in SEZs will actually compensate this revenue loss. Crores of job then eradicate poverty from India and at the end poor Indian people will be benefited.

Nowadays the advocates of globalization are talking too much about job opportunities. Cleverly what they hide is the fact that in industries there is an increasing trend of recruiting contractual labour workers. They are the main work force now. They don’t have any professional security and most of the cases extremely underpaid. They have to work more than eight hours a day. If it continues then how increasing job opportunities will help? It simply cannot be. If somebody has a job, but he earns the salary not enough to provide minimum calorie to his family then it doesn’t help.

In this context it is important to understand that companies make profit out of the labour. It is the essence of capitalist mode of production, in other word capitalist exploitation. In the initial stage of capitalism the wage of a labour was enough to sustain his family. The average profit was enough to satisfy the capitalists. But, capitalists cannot make profit unless they sell the commodities. That means capitalism needs market. As capitalism grows, due to its exploitation it excludes more and more people from its market, which in turn makes more and difficult to ensure the profit.

With time capitalism has been entered its moribund stage, the imperialism, where monopoly dominates; centralization of capital becomes the main trend. After Second World War it has been reached such a phase when it requires maximum profit.

Maximum profit means maximum exploitation. Thanks to imperialist exploitation (actually plunder) that most of the people of the world become so poor that they are actually excluded from imperialist market. So imperialism simply doesn’t care for them. Different mainstream parties, government and mainstream media as the faithful agent of imperialism, are only concerned how their “bosses” can ensure the maximum profit.

This is the reason they dare to advocate SEZs and acquisition of farmland fully knowing that it is nothing to do any good for common poor Indian people, who are marginalized in the imperialist market. They are so faithful to serve the interest of imperialism and their comprador big Indian capitalists that they even don’t feel ashamed to falsify the fact: SEZs and acquisition of land will eradicate poverty from India. . Actually it is absurd to protect the interest of both imperialism (and big comprador capitalists) and common people at the same time.

There are intellectuals who also support the stand of government. They have been trying their level best to make us believe that it is the way of development as exactly same thing had happened during the industrial revolution in Europe. Industrialization requires land, but finally who will be evicted can end up with better opportunity in industry.

These advocates of imperialist plunder use to forget that the stage of capitalism right now is absolutely different from the days of industrial revolution in Europe. In those days the law of capitalism was the “law of surplus value”; which means that although capitalists used to make profit, although it used to exploit, it used to give workers the wages sufficient to sustain his livelihood. In contrast, at the phase of total collapse of imperialism, when it is driven by the securing maximum profit, means maximum exploitation, it cannot assure the minimum calorie to the majority of population. Two contexts are qualitatively different. Today, even in western world, workers have been loosing their jobs, as for achieving maximum profit, big corporations outsource. Nothing could be more precious than maximum profit. But, those days were different during industrialization in Europe; monopoly had never been hard of, market was gradually increasing, capitalism was proliferating.

We cannot blindly extrapolate the experience of industrialization in Europe in today’s India. In Europe what happened was the development of capitalism, whereas in India in the name of industrialization government has been allowing big companies and corporation to secure maximum profit, in other words maximum exploitation. The difference will be clear if we consider the role of feudalism in two cases. In Europe the feudal system was destroyed and it supplied the workforce in industries. In India, totally opposite happens. As more and more imperialist capital comes, semi-feudal relations strengthen. For instances, this companies hire workers from labour supply agencies. What is the role of these agencies? Their role is not better than as feudal lord. There are so many private big banks operating in India. They use to give loans and at the same time keep bunch of goons to get the monthly interest back at right time.

What does it indicate? So called industrialization, foreign investment doesn’t change the semi-feudal relations nowadays. The capitalism played a progressive role in history against feudalism. But, those days were gone century before when capitalism entered the stage of imperialism. Imperialism for its own existence now depends upon feudal relations in colonies and neo-colonies. In SEZs, there will be also full freedom for subcontracting including subcontracting abroad (2).

The model, which is being proposed with the name of SEZ, is therefore absolutely different from industrialization. What is going on is imperialist plunder at its highest level.

SEZ is to secure maximum profit to the big companies, not the minimum calorie to every Indian.

Note:

1.Facilities For Developers (http://www.sezindia.nic.in/fecilities_incentives.asp)

Developer of SEZ may import/procure goods without payment of duty for the development, operation and maintenance of SEZ.

Income tax exemption for a block of 10 year in 15 years at the option of developer as per section 80-IA of the Income Tax Act read with Appendix 14-II-N of Handbook of Procedure.

Full freedom in allocation of developed plots to approved SEZ units on purely commercial basis.

Full authority to provide services like water, electricity, security, restaurants, recreation centers etc. on commercial lines.

Foreign investment permitted to develop township within the SEZ with residential areas, markets, play grounds, clubs, recreation centers etc.

Develop Standard Design Factory (SDF) building in exiting Special Economic Zones. Guildlines at Appendix 14-II-N

Income Tax exemption to Investor's in SEZ's under section 10 (23) G of Income Tax Act.

Exemption from Service Tax

Investment made by individuals etc. in SEZ company also eligible for exemption u/s 88 of IT Act.

Development promoted to transfer infrastructure facility for operations and maintenance u/s 80-I-A of IT Act

Generation, Transmission and Distribution of Power in SEZs allowed.

2. Indian SEZ - Salient Features and Facilities (http://www.sezindia.nic.in/facilities_enterprise.asp)

A designated duty free enclave and to be treated as foreign territory for trade operations and duties and tariffs.

No licence required for import.

Exemption from customs duty on import of capital goods, raw materials,consumables, spares etc.

Exemption from Central Excise duty on procurement of capital goods, raw materials, consumable spares etc. from the domestic market.

Supplies from DTA to SEZ units treated as deemed exports.

Reimbursement of Central Sales Tax paid on domestic purchases.

100% income tax exemption for a block of five years,50% tax exemptions for two years and upto 50% of the Profits ploughed back for next 3 years under section 10-A of Income tax Act.

Supplies from DTA to SEZ to be treated as exports under 80HHC of the IT Act.

Carry forward of losses

100% Income-tax exemption for 3 years & 50% for 2 years under section 80-LA of the Income-tax Act for off-shore banking units.

Reimbursement of duty paid on furnace oil, procured from domestic oil companies to SEZ units as per the rate of Drawback notified by the Directorate General of Foreign Trade.

SEZ units may be for manufacturing, trading or service activity.

SEZ unit to be positive net foreign exchange earner within three years.

Performance of the units to be monitored by a Committee headed by Development Commissioner and consisting of Customs.

100% Foreign Direct Investment in manufacturing, sector allowed through automatic route barring a few sectors.

Facility to retain 100% foreign exchange receipts in EEFC Account.

Facility to realize and repatriate export proceeds within 12 months.

Re-export imported goods found defective, goods imported from foreign suppliers on loan basis etc. without G.R. Waiver under intimation to the Development Commissioner.

"Write-off" of unrealised export bills upto 5%.

Commodity hedging by SEZ units permitted

Capitilization of import payables

No cap on foreign investment for SSI reserved items.

Exemption from industrial licensing requirement for items reserved for SSI sector.

Profits allowed to be repatriated freely without any dividend balancing requirement.

Domestic Sales on full duty subject to import policy in force.

No fixed wastage norms.

Full freedom for subcontracting including subcontracting abroad.

Subcontracting facility available to jewellery units

Duty free goods to be utilized in 5 years.

Job work on behalf of domestic exporters for direct export allowed.

No routine examination by Customs of export and import cargo.

No separate documentation required for customs and Exim Policy.

In house customs Clearance.

Support services like banking, post office clearing agents etc. provided in Zone Complex.

Developed plots and ready to use built up space

Exemption from Custom/Excise Duty on goods for setting up units in the zone.

3. "The estimated revenue loss from tax concessions to Special Economic Zones (SEZ) to over Rs 1 lakh crore for the period 2006-07 to 2009-10." Mr. S. S. Palanimanickam, Minister of State of Finance through a written reply in parliament on Nov 24, 06.

1 comment:

Hello mmate nice blog

Post a Comment